In our final property news roundup for 2019, we round up all of the property market predictions for 2020!

We found 3 summaries of predictions from Property Update, Open Agent and Savings.com.au.

In our first summary, Property Update summarises Finder.com’s research with a panel of economists who were presented with a bunch of likely scenarios.

Here’s what went down:

So what did the Finder.com predictions say?

From the article

Expectations for the housing market look promising, with 52% of the panel of experts expecting house prices to fully recover to above pre-decline levels in 2020.

This compares to only 12% of experts who expect house prices to fall.

Read the full article here for a full economic range of predictions. Here is the link to the original Finder.com data.

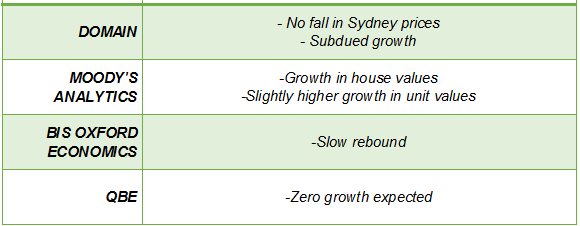

The team at Open Agent have also pulled together data from team of experts to find out what might happen in 2020.

What is the 2020 summary at Open Agent?

In summary, here’s what the consensus is at Open Agent

2020 looks to be a slow year for the Sydney property market. However, not many experts believe the market will continue sliding past the new year. 2020 is touted for growth, even if only the slightest. But small figures will be enough to further bolster investor confidence.

Over at Savings.com.au, they spoke to Propertyology’s Head of Research Simon Pressley. Here’s what he had to say:

“…growth in median dwelling prices over the next five years to be superior to the last five years and more widespread, as opposed to being concentrated on a select few locations,” Mr Pressley said.

However, he labelled it a “futile exercise” to predict property price growth for the next year.

“There is nothing orderly about Australian property markets right now. Wild swings from a deep downturn at the start of 2019 to (sugar-fix) boom conditions by the end of the year is the definition of an unstable market,”

And what is our property prediction? Here is what our director, Andrew Phanartzis said:

Continued improvement in lending policies, will provide buyers with the confidence to re-enter the market. Also, there are likely to be further falls in interest rates. This coupled with the limited development starts will see the balance between supply and demand restored.

What are your thoughts?