What’s happening in Melbourne property? Will prices go back up? It’s a question we’ve been asked a few times from our followers so we decided to lay out some data and predictions.

We cover a variety of aspects that impact the property market. That includes rents, prices, construction activity, demand and loan approvals.

Melbourne Property Market: 5 Key Indicators

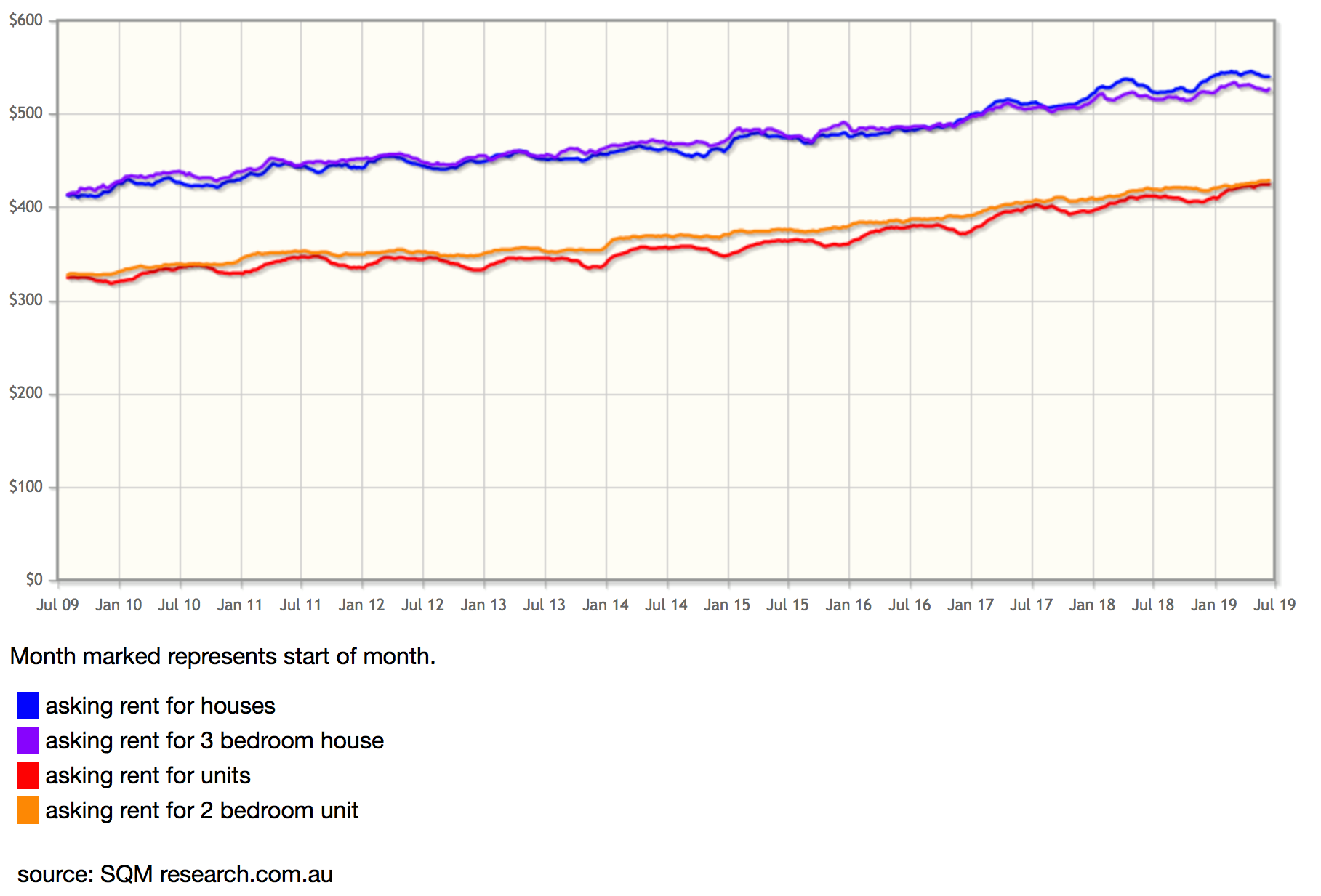

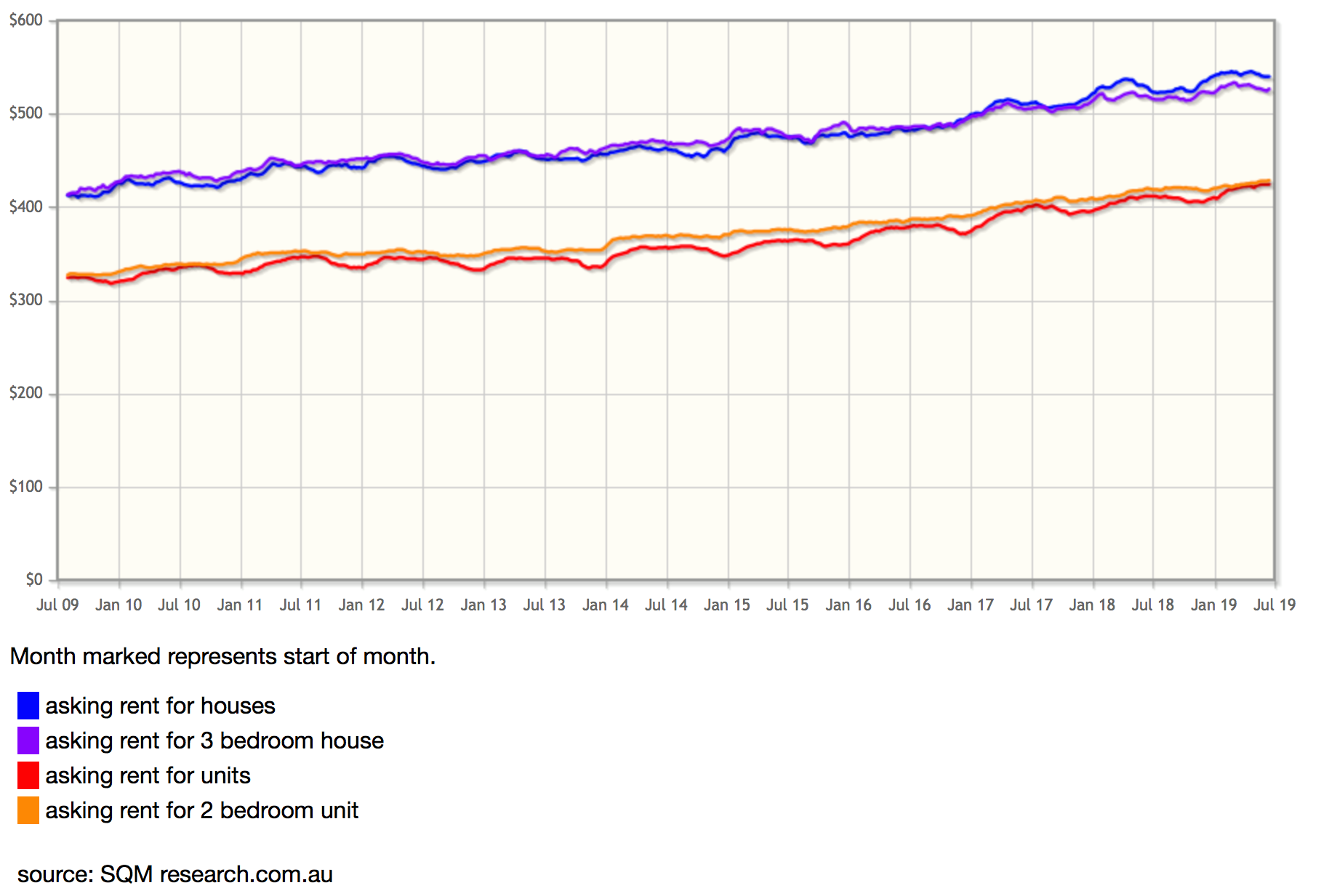

Rents

Rents in Melbourne have increased in the last quarter, and have steadily risen over the last 10 years. We know of course, after rents go up – is when investors come into the market, pushing prices up.

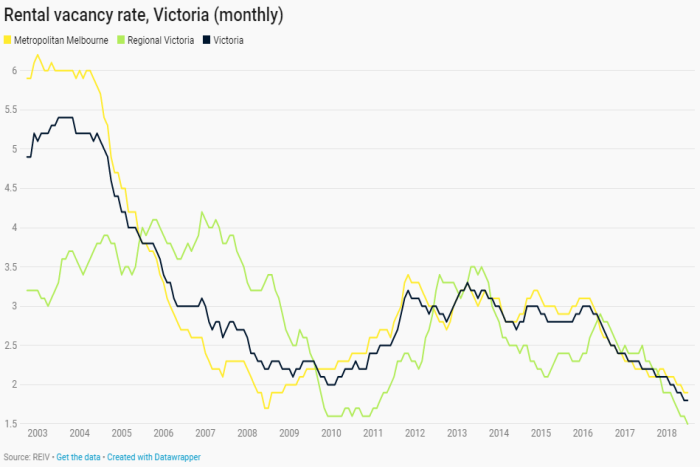

Vacancy Rates

The rental increase has come off the back of the low vacancy rate (which is likely due to Melbourne’s higher population intake), which in turn does tend to see investors jump into the market.

Prices

After a year of bottoming out and flat-lining, it looks like the Melbourne prices are leveling out. How much longer we have till we see an increase is anyone’s guess.

Interestingly enough, units have seen less of a decline. Melbourne prices have dropped slightly lower than Sydney prices.

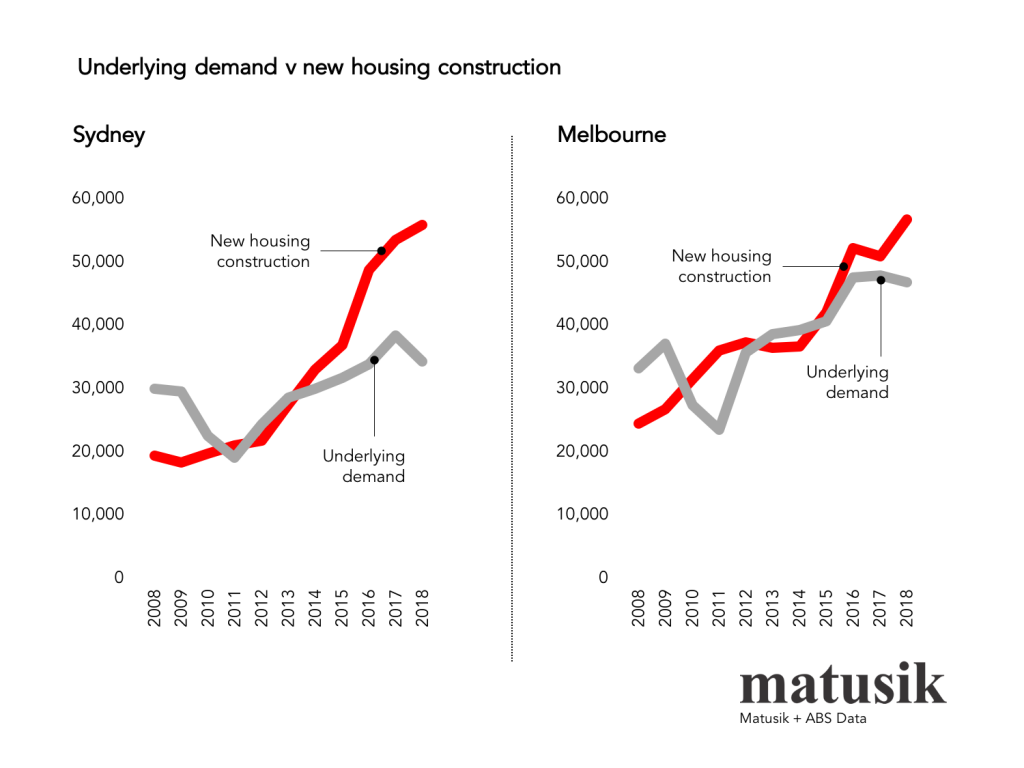

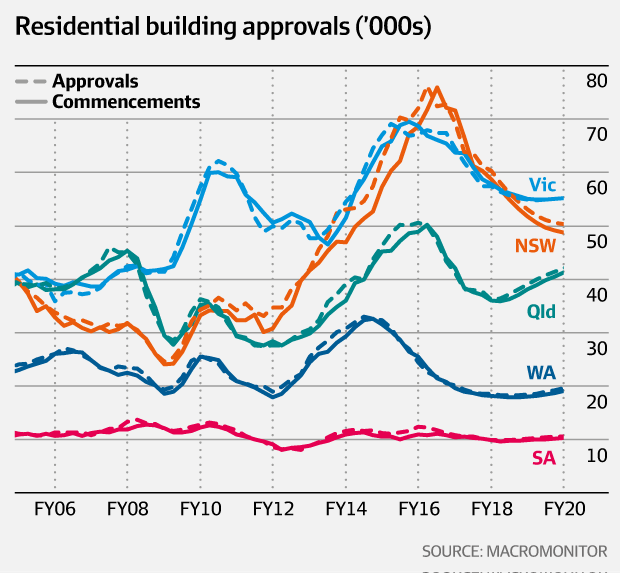

Construction Activity

According to a piece in the AFR:

“An analysis by The Australian Financial Review of Cordell/CoreLogic data showed about 21,000 out of about 36,000 approved apartments in Melbourne worth about $6.5 billion over the two years (at the height of the housing boom in 2014 and 2015) have been categorised as “deferred” or “possible” but have not firmed up to go ahead”

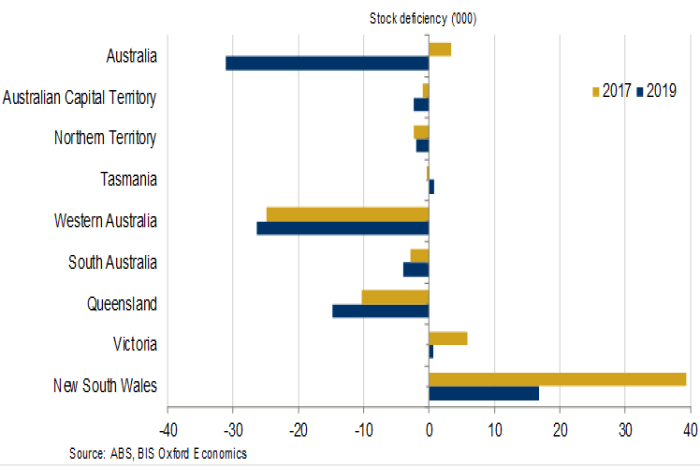

This indicates that there may be an impending under-supply by the time the market is back up.

Demand

Melbourne has very strong population growth, and coupled with the possible decline in construction completion, could see some increasing demand for housing over the next few years.